Agricultural Commodities

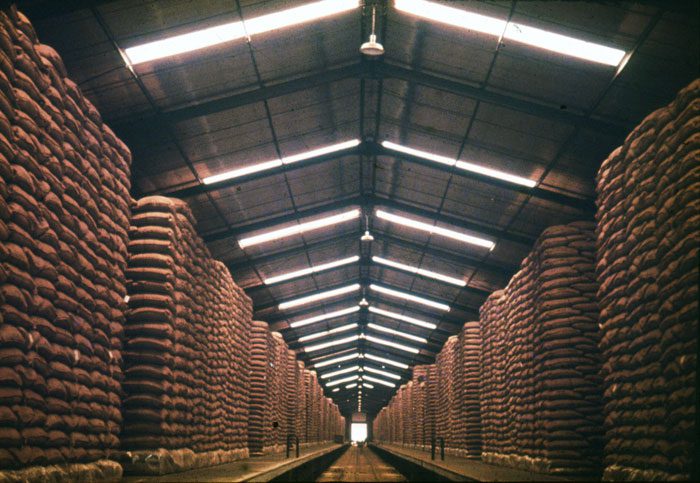

The agricultural investment portfolio offered by Quantum Holding is tailored for investors seeking exposure to the agricultural market through a diverse range of assets. This investment package encompasses stakes in physical agricultural commodities such as wheat, corn, soybeans, and cotton, alongside investments in publicly traded agricultural companies and funds.

A seasoned team of investment professionals manages the portfolio, leveraging a blend of quantitative and fundamental analyses to handpick strategic investments. The portfolio is intentionally diversified across different agricultural commodities to mitigate risks and optimize returns.

Investing in agricultural commodities can act as a safeguard against inflation and currency fluctuations while serving as a secure refuge during periods of economic uncertainty. Furthermore, agricultural investments offer valuable diversification benefits within a traditional investment portfolio.

Total Value In Assets

+$789M

Wheat

Investors use wheat to diversify, as a hedge against inflation and in search of profit as the cultivation and use of wheat increases in many countries.

Total Value In Assets

+$882M

Palm Oil

Palm oil production can yield high returns, with an average profit margin of 30%. As the demand for palm oil continues to increase. Quantum Holding invest into export and production of palm oil around the world.

Total Value In Assets

+$639M

Cocoa

Cocoa is another major Agricultural Commodities Quantum Holding trades with a high of 23% ROI.

Total Value In Assets

+$1.01B

Coffee

Coffee is one of the most valuable commodity markets in the world, estimated to produce $460 billion in revenue in 2022 alone. Coffee requires a very specific climate to grow, which is why the commodity coffee market is dominated by a handful of low and middle-income countries.

Total Value In Assets

+$978M